FIRE – Financially Independent, Retire Early

FIRE (also known as Financially Independent, Retire Early) is a…

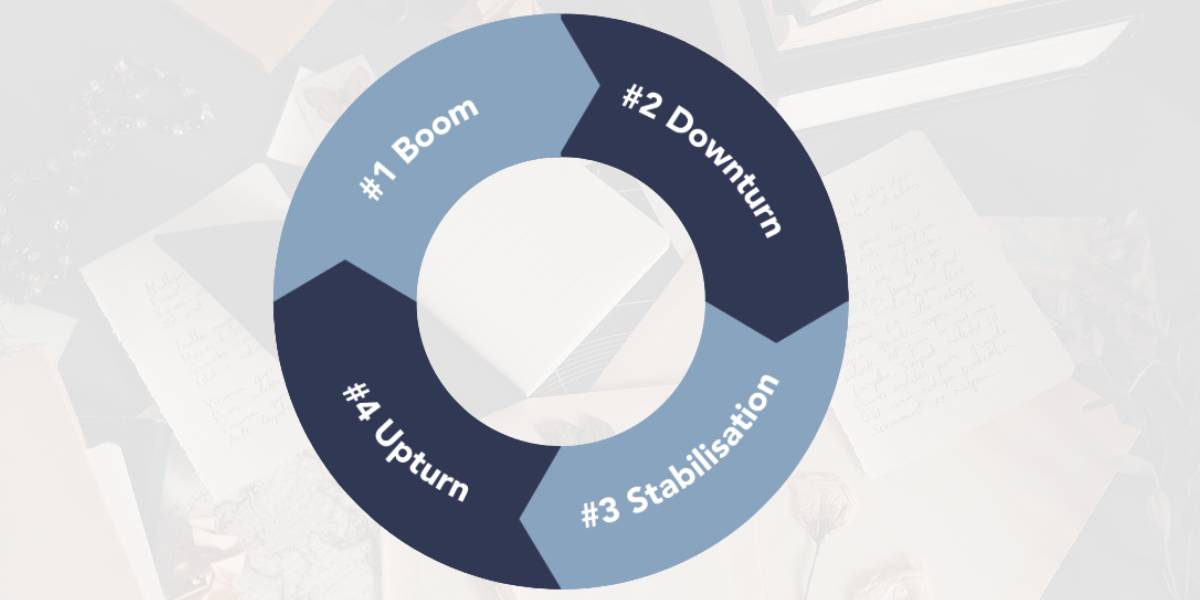

For property investors, understanding the property cycle has long been considered essential, acting as a guideline in helping identify the best times when to buy, hold, and sell, in anticipation of what comes next.

Supply: Mid-High

Demand: High

This is the stage that investors eagerly anticipate. Property prices grow rapidly, demand peaks, and clearance rates soar. If you’re looking to sell, this is a popular time to do it.

Usually lasting just 1-2 years, this phase prompts investors to closely monitor the closing stages of the previous cycle, to act swiftly and capitalise on the boom effect before it ends.

Supply: High

Demand: Mid-Low

Following a property boom, demand eventually drops, while the supply stays high due to activity from developers. This leads to the downturn phase, marked by signs such as increased vacancy rates and declining rental prices. It’s not uncommon to see a decline in property prices, and developers may face redundancies and financial vulnerabilities.

This phase often lasts 3-4 years and can stretch longer following a prolonged ‘boom’.

Supply: Mid

Demand: Mid

During the stabilisation stage, the market adjusts to an excess of property supply and reduced demand. Interest rates tend to decrease, and property values begin a gradual recovery.

This period can be an opportune time for investors, as lower prices and reduced market competition make it an appealing time to buy.

Supply: Mid

Demand: High

As buyers return to the market, competition increases, driving down vacancy rates and pushing up rental and property prices. Developers start significant projects, aiming to complete them as the boom phase hits.

The upturn typically lasts 3-4 years as property prices grow, setting the stage for the next ‘boom’.

EXCELLENTTrustindex verifies that the original source of the review is Google. We would like to thank Sahil and team, I was referred by a friend who told me how great their experience was, Sahil's attention to detail and knowledge is above what I have had with any other brokers. Sahil is a pleasure to deal with and we look forward to working further with him and team in the future. Thanks for all your efforts Sahil we appreciate it.Posted onTrustindex verifies that the original source of the review is Google. We found the Strawberry team professional, knowledgeable and very responsive. It made the process so much more easier. They were well connected and being new to WA we found that so helpful. We were recommended Sahil and Strawberry Finance team and would be happy to do the same.Posted onTrustindex verifies that the original source of the review is Google. I had such a great experience working with Sahil at Strawberry Finance. They were incredibly prompt, helpful, and well-informed throughout the entire process. Everything was explained clearly, and their friendly, professional approach made what can be a stressful experience feel easy and straightforward. It’s been a true pleasure working with them, and I’ll definitely be recommending Strawberry Finance to friends and family looking for expert loan advice or better mortgage options. Thank you for all your help!Posted onTrustindex verifies that the original source of the review is Google. I got my formal approval today for H&L with Sahil at Strawberry Finance. Sahil has been professional, prompt and always communicated, and followed up with all parties to ensure the deadline is met. He took all the stress away and made the process smooth and fun. If you are looking for someone who will go above and beyond to find a solution for your circumstance and assist you in getting your loan for your dream home, don’t even second guess and just call this guy. He will sort it out. Thanks Sahil and team for helping me with mine home.Posted onTrustindex verifies that the original source of the review is Google. Sahil from Strawberry Finance is an outstanding mortgage broker! Every client I’ve referred to him has had a smooth and positive experience. He’s professional, responsive, and always goes the extra mile to make the process stress-free. The feedback has been nothing but excellent highly recommend Sahil and the team at Strawberry Finance!Posted onTrustindex verifies that the original source of the review is Google. Sahil and his Team at Strawberry Finance has helped few of my clients recently. They go above and beyond to get the job done - i highly highly recommended them to anyone needing finance. Thank you Sahil and the team at Strawberry finance.Posted onTrustindex verifies that the original source of the review is Google. ⭐️⭐️⭐️⭐️⭐️ We recently worked with Sahil to secure our home loan, and I honestly can’t thank him enough! 🙌 From day one, Sahil was incredibly professional, patient, and always went the extra mile to explain every detail in simple terms. 🏡✨ He not only got us an amazing deal 💰 but also guided us through the entire process with so much care and dedication. What could have been a stressful experience actually turned into a smooth and enjoyable journey thanks to him. 🙏 Sahil was always available to answer questions (no matter how big or small), super responsive, and genuinely had our best interests at heart. ❤️ His knowledge of the industry, attention to detail, and commitment to helping us achieve our dream home were second to none. If you’re looking for a mortgage broker who truly cares, look no further than Sahil! 👏👏 Highly recommended to anyone wanting a stress-free, professional, and positive experience. 🌟Posted onTrustindex verifies that the original source of the review is Google. They've been very helpful and professional!highly recommendPosted onTrustindex verifies that the original source of the review is Google. Very helpful and professional!Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

FIRE (also known as Financially Independent, Retire Early) is a…

Your home loan repayments are likely to be the biggest,…

When making an offer, it is important to remember that…